Law360, Dallas (February 17, 2017, 3:41 PM EST) — The Texas Supreme Court on Friday said it would not review wealth management and capital markets firm Morgan Keegan’s argument it was wrongly held liable for not telling investors the true risks of a mortgage-backed securities stake, leaving intact a $2.1 million judgment.

The court denied without comment a petition for review filed by Morgan Keegan & Co. Inc. that argued a lower appellate court “dramatically expanded liability under the Texas Securities Act” when it held the firm had violated state law by misrepresenting the true risks and speculative nature of securities bought by two bond funds managed by Morgan Asset Management and underwritten by Morgan Keegan.

Morgan Keegan and former affiliate Morgan Asset had argued the lower court’s ruling wrongly expanded secondary liability under the act to permit recovery against a party purely because of its status as underwriter or investment adviser, without any evidence of intent. It also argued the secondary violation of the act was not tied to a primary violation.

The firm had sought to upend a $2.1 million judgment, rendered after a bench trial, in favor of investors Purdue Avenue Investors LP and its principals, Robert and Dana Howard. Responding to Morgan Keegan’s appeal, the investors argued they had presented ample evidence at trial supporting the finding of primary liability based on failure to comply with securities regulations, and said the trial record showed the firm had a general awareness or intent sufficient to affirm the damages award.

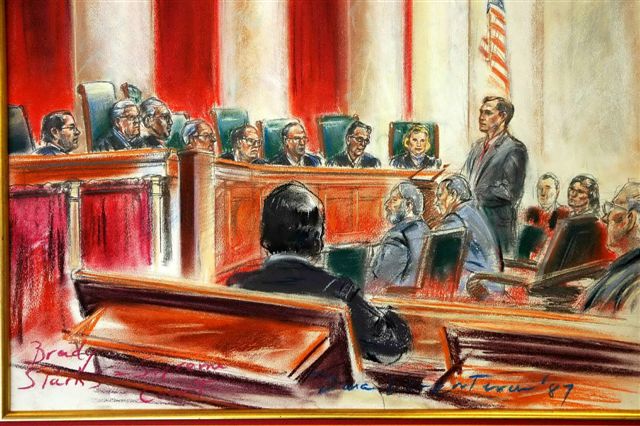

“The Supreme Court merely recognized the Court of Appeals didn’t make any mistake in holding the evidence showed MAM and Morgan Keegan were directly and intimately involved in the fraud,” Brady Sparks of Braden Sparks PC, an attorney for the investors, told Law360 Friday.

Attorneys for Morgan Keegan didn’t immediately respond to a request for comment.

The Fifth Court of Appeals in May held a trial judge had wrongly decided the case based upon a finding that the Morgan Keegan entities were liable as issuers of securities. A panel of the court modified the judgment to reflect an alternate legal theory establishing Morgan Keegan liable for primary and secondary liability under the act.

According to the suit, the Howards invested over $2 million in RMK Advantage Income Fund and the RMK Strategic Income Fund. Morgan Keegan was one of the funds’ primary underwriters, while Morgan Asset was the investment adviser that managed the funds’ portfolios. The funds ultimately lost over $2 billion and the Howards lost their investment, according to the opinion, prompting their claims that the Morgan entities failed to disclose the funds’ overwhelming and risky exposure to mortgage-backed securities.

The panel further held that the Howards’ claims were not barred by the TSA’s statute of limitations. The Morgan entities argued that the Howards knew or should have known of the alleged misrepresentations no later than the fall of 2004, but failed to sue until 2009, well outside of the TSA’s three-year limit after discovery of one’s claims.

Morgan Keegan argued that the Howards knew of the exact risk they are complaining about — that the bond funds were concentrated in below investment-grade structured finance — since that was expressly disclosed in a 2004 report by the funds.

But the panel held that evidence introduced at trial, including evidence that the fund’s prospectuses and other reports were materially misleading and failed to disclose the true risks of investment, is enough to support a finding that the Howards filed suit less than three years after they discovered the alleged untruth or omissions underlying their claims.

The Morgan entities are represented by Peter Fruin and Kathryn Roe Eldridge of Maynard Cooper & Gale PC and Kenneth Johnston and David Clem of Kane Russell Coleman & Logan PC.

The plaintiffs are represented by Brady Sparks of Braden Sparks PC and Samuel Edwards of Shepherd Smith Edwards & Kantas Ltd. LLP.

The case is Morgan Keegan & Co. Inc. et al. v. Purdue Avenue Investors LP et al., case number 05-15-00369-CV, in the Texas Court of Appeals for the Fifth District.

–Additional reporting by Stewart Bishop. Editing by Emily Kokoll.

Article By Jess Krochtengel